Carter Bakkum, Senior Data Analyst, Healthcare Insights

Carter is a senior data analyst who works to turn complex, messy data into actionable intelligence. Carter studied economics and statistics at the University of Virginia before joining an economic consulting firm, where he supported expert testifying economic witnesses on behalf of fortune 500 healthcare companies. After the significant changes in the importance of data analytics during the pandemic, Carter joined the Trella team to dive deeper into the numbers to uncover the stories that drive our experience.2020 Post-Acute Discharge Trends

By Carter Bakkum | June 10, 2021

It’s safe to say that post-acute care (PAC) organizations have faced significant challenges and disruptions over the last year. With that in mind, by looking at post-acute discharge trends, we can gain visibility into industry-wide movements and opportunities for home health agencies, skilled nursing facilities (SNFs), and hospice providers in 2021 and beyond. For this article, we selected an analysis period between Q4 2016 through Q4 2020 with a focus on:

- Post-acute discharge instructions

- Post-acute discharge settings

By looking at these metrics individually and together, we can make informed conjectures about the causes of some behaviors, areas for improvement, and possible opportunities for PAC organizations to grow in 2021.

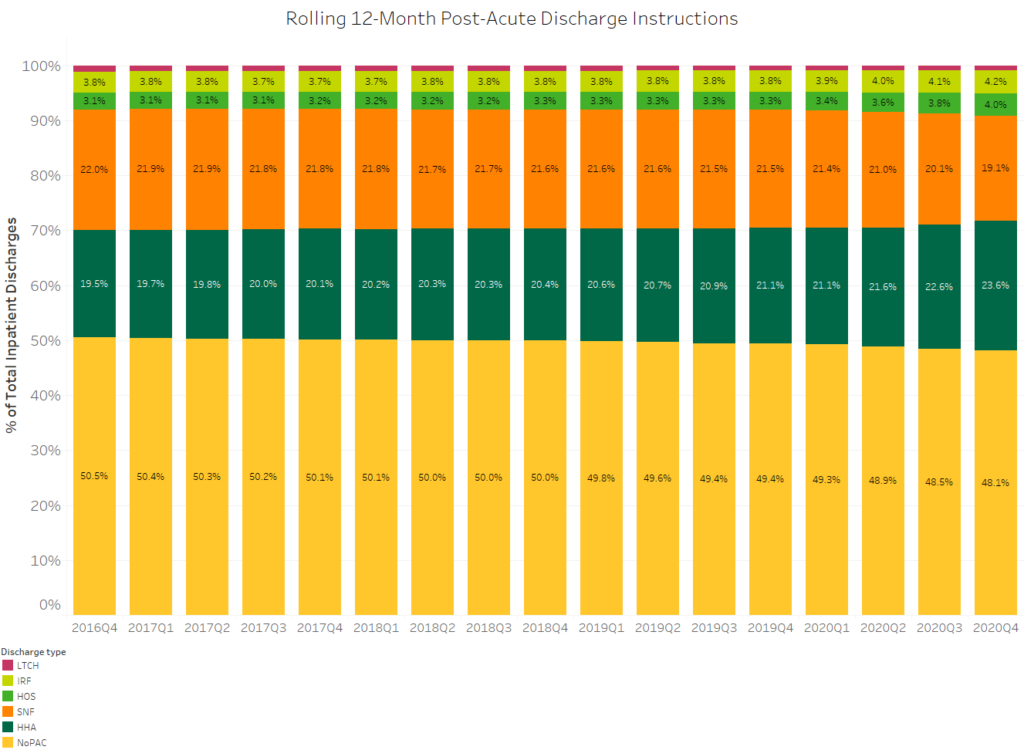

2020 Post-Acute Discharge Instructions

Over the last four years, post-acute discharge instructions have increasingly favored PAC agencies. The number of inpatient discharges with no post-acute care instructions decreased from 50.5% in 2016 to 48.1% in Q4 of 2020. While this may seem like a slight increase over four years, it’s significant that more than half of all inpatient discharges are now instructed to receive at least one type of post-acute care.

While post-acute discharge instructions are on the rise, they are not uniform across the post-acute care continuum. Trends over the past year indicate an increasing preference for home health care, with home health discharge instructions increasing from 21.1% to 23.6% between 2019 and 2020. This well-documented shift is typically attributed to patients’ increasing preference to receive care at home rather than in a facility. Further, while this trend was documented before the COVID-19 pandemic, an inclination toward home care was likely accelerated due to fears over COVID-19 exposure and measures taken by some states to quarantine COVID-19 patients in SNFs. These factors may have pushed both patients and physicians away from SNFs and toward home health throughout 2020.

Though not as pronounced over the analyzed period as home health, hospice has also seen increased post-acute discharge instructions. From 2016 to 2020, discharge instructions to hospices increased from 3.1% to 4.0%. This slight but notable increase could be related to growing efforts to utilize hospice care when appropriate. As the Trella team has found in previous analyses, early hospice care has significantly improved healthcare and end-of-life costs for patients and their families.

Accelerated SNF Decline

COVID-19 ravaged the SNF industry, from increases in PPE expenses to stringent measures, such as social distancing and significant decreases in the total number of occupied beds allowed in an area. While we can at least in part attribute a decline in SNF referrals to the COVID-19 public health emergency, the overall trend for discharge instructions to SNFs has been consistently down for the past four years. Between 2016 and 2019, SNF referrals decreased consistently by about 0.2 percentage points per year. However, the most significant decline came between 2019 and 2020, when discharge instructions dropped from 21.5% (2019) to a shocking new low of 19.1% — 2.4 percentage points in a single year.

Given SNF trends over the past few quarters, this decline isn’t shocking – however, accelerated it may have been. One trend that was noteworthy – and unexpected – was the increase in referral rates to Inpatient Rehab Facilities (IRFs). Most of the change occurring between 2019 and 2020 may be due to a different population entering inpatient stays, as elective procedures were suspended due to the pandemic.

An alternate explanation could be the addition of IRF wings to inpatient hospital systems and the subsequent internal patient referrals. Their attempt to retain revenue from post-acute care had unintended consequences of decreasing SNF referrals for appropriate patients. If you have thoughts on why this change may have occurred or any other PAC referral trends, we’d love to hear from you! Let us know about your organization’s experience and what you’ve taken from it.

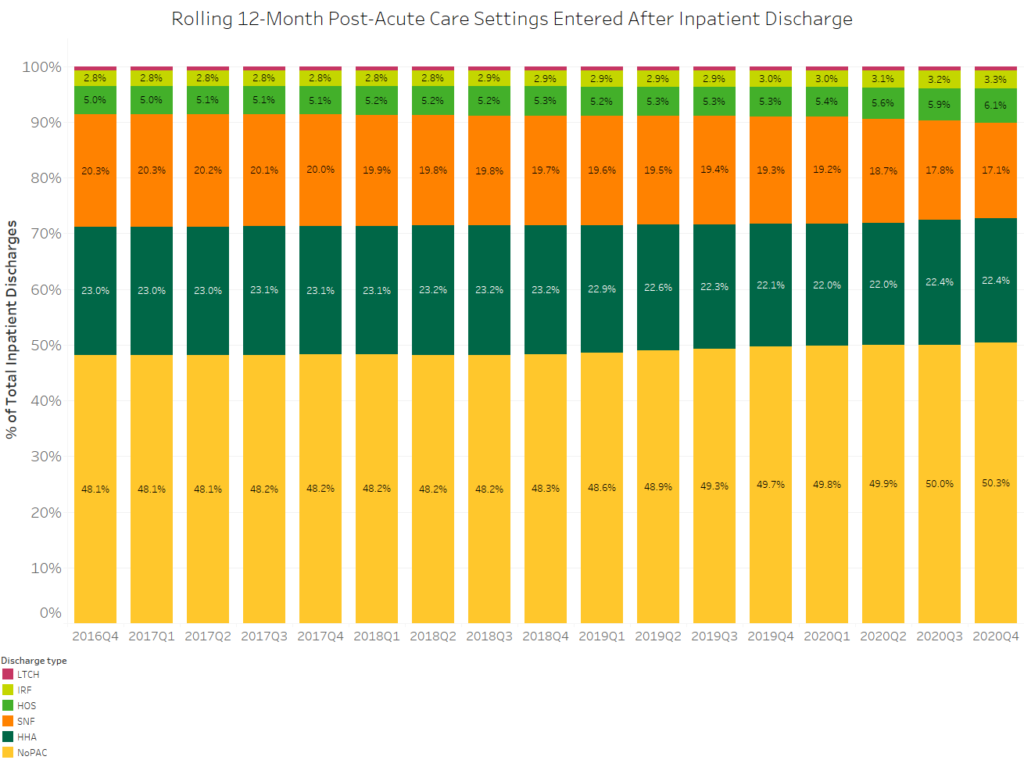

2020 Post-Acute Discharge Care Settings

While PAC discharge instructions saw increases in the analysis period, the percentage of inpatient discharges that do not enter post-acute care settings has increased from 48.1% in 2016 to 50.3% in 2020. While COVID-19 and fears around post-acute care agencies may have contributed to the increase between Q1 2020 and Q4 2020, we can trace this trend as far back as the beginning of this data set in 2016. Of the 2.2% increase in that period, only 0.6 percentage points occurred in 2020. Thus, it’s safe to say that this is an ongoing trend and cannot solely be attributed to the pandemic.

To understand why the percentage of inpatient stays that entered post-acute care has decreased, let’s look at the percentage of inpatient discharges receiving home health and SNF instructions. Patients instructed to enter home health care showed lower adherence than patients directed to enter SNF care. Considering this, the increasing movement toward home health discharge instructions – combined with lower home health adherence – could be a significant factor driving the decrease in inpatient discharges despite increased PAC discharge instructions.

Conversely, a much higher number of inpatient discharges enter hospice care within 30 days than were instructed to do so. This may indicate the need for more education for physicians around accurately identifying patients that are appropriate for hospice care. At the same time, while some patients are incorrectly discharged to hospice, it’s been documented that more than 6.1% of inpatient discharges appropriate for hospice care will likely never receive it. This represents an opportunity for hospice agencies to increase their referrals – simply by capturing the total population for which their care is appropriate.

Finally, as we compare discharge instructions with patients’ actual care settings upon discharge, it’s interesting to note that adherence for rehab facilities appears to be consistent over the past four years, as the trajectory in this graph is similar to that of the instructions graph. Again, this highlights the importance of digging into the data and comparing metrics. Suppose discharge instructions and patient adherence aren’t aligning. In that case, it’s worthwhile to look further to the causes of disparities and compare them to cases in which there is more alignment, as with rehab facilities.

Next Steps

By tracking these trends over a four-year analysis period, we can get a clearer view of post-acute care industry trends. We can then compare data from 2019 through 2020 against previous years for a deeper understanding of overall market trends, the impact of COVID-19, and where opportunities lie for PAC organizations to grow their networks and gain more of the right referrals to continue improving patient outcomes while controlling costs.

If you have questions regarding post-acute discharge, adherence, and PAC setting trends in your market, send an email to [email protected]. Want more in-depth insights into trends that impact your industry and your business? Schedule a demo of Marketscape today.