Mike Neuman, VP of Data Science and Engineering

Michael is a transformative, data-driven healthcare management professional that delivers on his passion for improving healthcare for providers, patients, and their families. With over 15 years of experience enabling healthcare operations, Michael is responsible for directing and implementing Trella's Data Science and Engineering organization. His role not only oversees the protection and diversification of data assets but ensures that they are fully leveraged to provide the most value to the industry. Prior to joining Trella, Michael spent his career developing high-functioning analytics teams in some of the most recognized Academic Medical Centers in the nation, including Duke Medicine, Jefferson Health, and SUNY Upstate Medical University. In these roles, he executed strategies for improving financial health, quality outcomes, and patient experience by building best-in-class data platforms. Michael earned a Master of Public Health from the University of North Carolina's School of Public Health and holds a Bachelor's degree in Computer Science from the State University of New York.The DL on MA Data: Understanding the Importance of Medicare Advantage

By Mike Neuman | April 8, 2021

Medicare Part C – also known as Medicare Advantage (MA) – enrollment has been on the rise for the past few years. A few short years ago, MA beneficiaries made up only 15% of all Medicare enrollments. Today, that number has climbed to a staggering 40%. In fact, in our recently published 2020 Industry Trend Report, we noted that, while traditional fee-for-service (FFS) enrollments declined by 700,000 from Q2 2019 to Q2 2020, MA enrollments increased 2.1M year-over-year. The likely reasons behind this shift are numerous – as are its implications for post-acute care (PAC) organizations. Let’s look at what an increase of MA beneficiaries means for your PAC and how you need to adjust.

Changing Demographic Needs

Traditionally, Medicare plans have served an aging population with specific needs. As lifestyles improved and life expectancies lengthened, the healthcare costs for patients and the Federal government have changed. Today’s seniors are looking for more cost-effective healthcare plans that cover more routine, low-acuity health scenarios – including vision and dental, which aren’t included in Part A or B plans. Caring.com states, “For healthy baby boomers with limited health concerns, the premiums, copays, and deductibles required by Medicare Advantage plans are very affordable.” And, if President Biden’s healthcare legislation passes, expanding Medicare eligibility to those 60 and older, there will be a new, even more robust influx of low-needs Medicare beneficiaries. Many of whom will likely opt for the more inclusive, less expensive MA plans. However, MA plans aren’t for everyone and certainly aren’t without their faults – limited service areas and less flexibility with eligible providers may keep some seniors locked into more traditional plans.

Regulatory Priority Adjustments

Like the shifts we’re seeing in the overall patient population, government priorities and regulations have also shifted. Medicare FFS plans typically offer no incentives to optimize patient outcomes and costs. The result is a reduction in care coordination, a potential increase in readmission or hospitalization, and an increase in total cost of care – an overage left for the government to pick up. But value-based care is rising dramatically in priority – programs promoting risk-sharing and cost capitation like Accountable Care Organizations and Direct Contracting Entities are examples of this. Medicare Advantage has similar priorities. One Health Affairs research article noted, “Medicare Advantage plans benefit financially from avoiding unnecessary use of post-acute care and hospital readmissions, and thus they have an interest in carefully selecting and coordinating post-discharge care.” With more emphasis on cost efficiency, providers need to think strategically about where they send patients and how they leverage post-acute care.

Better Visibility with MA Data

Today’s most successful post-acute care providers know that visibility into performance, competition, market-level benchmarks, and partnerships help drive resource allocation and overall business strategy. In Trella’s recent webinar, “4 Strategies for Creating a Competitive Advantage for Your Agency,” Kristen Duell, Executive VP at KanTime, mentioned, “if cash is King [in post-acute care], data is the castle the King lives in.” Using data to inform broader business decisions – mergers and acquisitions, partnerships with ACOs or Health Systems, and even staffing and recruiting improvements – will result in better outcomes and cost-efficiency.

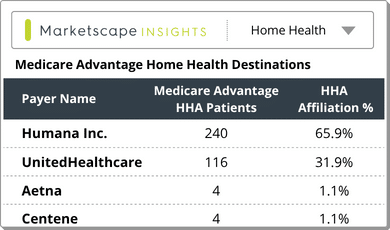

As the need for more visibility into the entire patient’s care journey continues to grow, you must have the most robust data sets available. By finding an analytics provider that has access to Medicare Parts A, B, and C will allow your organization to optimize in three key ways:

- Understand and address the needs of your market’s patient mix.

First and foremost, having access to Medicare Parts A, B, and C will show a market-level breakdown of all the patients in your area. What types of claims are most prevalent? If you don’t already accept Medicare Advantage patients, but there is a growing MA population in your area, you likely won’t be the PAC destination of choice for referral partners. What about acuity levels? Care settings? Understanding where patients in your market are going will help you ascertain if you need to make operational changes to your PAC or if you need to tell a more compelling value story to your partners. - Identify potential partnerships to pursue.

If you’ve recently started accepting Medicare Advantage patients, there could be an untapped pool of patients within your market. Start by identifying which existing partnerships treat a high number of MA patients and inform them of your new availabilities or explore partnerships with MA-heavy physicians or hospitals that you haven’t yet approached. - Create a compelling competitive advantage.

Cliché as it may sound, knowledge is power. You may be used to analyzing your market’s competitive landscape, but without visibility into MA claims, you don’t have the whole picture. Which of your competitors see the most MA patients? How do you compete with them in outcomes, readmissions or hospitalizations, and total cost of care? Are there certain diagnostic groupings that you have better outcomes for? Leverage this data to build a compelling story for all of the patients in your market – and take a larger slice of the market share pie.

As a new wave of patients reaches Medicare’s age of eligibility, it’s essential to know what plans they’re choosing and how they’re impacting care patterns in your market. Medicare Advantage enrollments are on the rise, accelerated by value-based care initiatives. Does your PAC organization have the visibility it needs to adjust to the changing landscape?

Only Trella Health has the Medicare claims data you need, with 100% of Part A and B claims through the most recent reporting period as well as the most complete Medicare Advantage claims available from CMS. To see a sample of what our proprietary insights look like for your market, request your personalized demonstration of Marketscape today.

Have specific questions about how MA could impact your organization? Please send us a note at [email protected].