Whether you are leading a sales and marketing team or running the company, conversations about market data are essential and bound to occur.

The focus of market data is sometimes centered around how valuable and reputable it is. However, when it comes to growing your organization and setting your team up for success, you need to focus on how to leverage data.

You may need to dig a little deeper into the data and ask your team how they utilize it – in the field, in their messaging, to conquer their goals, or to connect with new referral sources.

When reading through this blog, one question to keep in mind through this article is: “how can you take the market data available to you and create compelling messages that will resonate with physicians and drive more referrals?” Let’s look at the best ways to leverage market data for Home Health, Hospice, and Skilled Nursing Facilities (SNFs) organizations.

Keep in mind: While the approach and tactics may be similar for each care type mentioned in this article, it’s important to communicate your uniqueness, what sets you apart, and why it is advantageous for the physician to referral to your care setting. Use data to tell your story.

Home Health data-driven messaging

What data is important to a home health referral source – aka what data should you bring to a meeting with these referral targets?

One way to really understand your organization’s strengths and weaknesses is to create a competitive analysis chart.

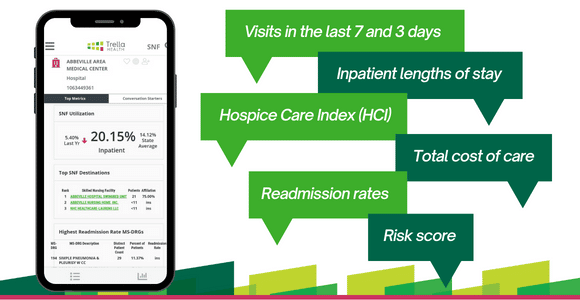

Some examples of data to include in the competitive analysis are:

-

-

- Total cost of care

- Average length of stat

- Time to start to care percentage

- Visits in the last 7 and 3 days

- Risk score

- Readmission rate

-

You can add more data to your analysis, but the ones mentioned above are a great starting point to help tell the story of how well your organization tends to its patients and what your strengths are.

Note: Make sure your team knows your organization’s strengths and talking points. You can help them practice that elevator pitch!

How do you translate this data into a compelling message?

How to utilize data in your talk tracks

Now that you’ve created a competitive analysis, the next step is understanding the data that matters and what motivates your referral sources. You can use this information customize a talk track for various personas.

Below are two persona-targeted talk track examples:

Physicians

A physician’s focus is their patients. When your sales reps are out in the field and connecting with physicians, they should create their talk tracks around physicians’ patients. The rep shouldn’t be spewing data and percentages alone.

For example:

“I saw that Janice was admitted to our services – I wanted to give an update because she’s taking advantage of our therapy program! We have a 4% readmission rate on therapy patients which is the lowest in the county.”

Hospitals

While physicians focus on patients, hospitals want to know about your readmission rates.

For example:

Discharge Events by Setting – Sometimes, a hospital may lose track of patients after they are discharged. This is where your reps can step in and highlight home health patients who fell through the cracks after being discharged.

Do you know if your hospital partners are discharging to post-acute? If you knew their discharge patterns, you could tell if they have lower adherence rates on certain types of patients.

Once your reps have a baseline for their talk track the fun part begins – talking about you.

What’s your unique story?

Implementing your unique story can be simple and easy to create inside the talk track. Just take the information from the competitive analysis such as: readmission rates, hospitalization rates, risk scores, types of patients, etc.

For example, if you take care of orthopedic patients better than your top competitors, center your talk track around that story.

Where do you shine?

After you define your unique story, the next step is talking about where you shine.

It can be hard but finding the right referral sources is important. Sometimes, “swimming upstream” for certain physicians – orthopedic surgeons, cardiologists, and pulmonologists are the referrals that are the driving force behind home health usage versus just working with primary care physicians.

Knowing how many home health patients a targeted referral source sees will help your sales reps personalize their messaging and show where your organization shines the brightest.

How do you compare?

So, you have your unique story written, and pinpointed where you shine, the last step in creating an enticing talk track is showing where you compare versus your competitors.

This is where you can take the data from your competitive analysis and paint a picture for your referral sources to understand why they should send their patients to you.

Remember: your organization doesn’t have to be the best at everything. It can be hard seeing another organization outperform you in a certain area, but it’s important to remember – every agency has a unique story to tell and not every story is the same.

With the data available to you, your reps can look back at the “start of care” data and see what percentage of patients are seen within the first two days, five days, and ten days. Having access to data and utilizing these metrics is what builds credibility with referral sources because it adds a comfort level knowing that you can get to those patients quickly.

Now that you’ve put together a unique story, pinpointed exactly where you shine, and stand out against your competitors, you are ready to create personalized talk tracks – with the support of data analytics – to help your reps connect with high-value and targeted home health referral sources.

Hospice data-driven messaging

What data is important to a hospice referral source – aka what data should you bring to a meeting with these referral targets?

The conversation around hospice can always be challenging. Either referral sources may not understand the benefits or want to have certain conversations with their patients. However, as a leader, you can prepare your sales reps to help providers feel comfortable with hospice services and having that conversation with them, as well as make them feel at ease that treatment may not be the best path forward.

Is it an educational conversation or should your rep prepare for a competitive conversation and discuss your organization’s strengths and weaknesses?

It’s important to have the most up-to-date data analytics to help understand where referral sources need your agency’s help – whether they are struggling with a short average-length-of-stay (ALOS) or are they just underutilizing hospice.

How do you translate data into a compelling message?

How to utilize data in your talk tracks

Knowing what to say to high-value referral sources is how sales reps can get their foot in the door. The best way to catch their attention and create a connection is to be very specific about their patterns.

With your data analytics, look at their underutilization – how many Medicare Fee-for-Service (FFS) patients do they have, and how many of those patients end up in hospice? As well as look at the average-length-of-stay and how that compares to other physicians in the territory.

The average-length-of-stay for a hospice patient and how it affects the patient’s family is always an important topic to cover with referral sources. Therefore, having your reps pinpoint your organization’s average-length-of-stay and how it helps them is an essential data point for your team to include in their talk tracks.

What’s your unique story?

As mentioned previously, having a unique story and how it relates to the targeted referral source is key.

When it comes to looking at hospice data, your reps should be looking at how many care visits occurred within the last three and seven days of life.

In addition, having a high number of RN, LPN, aide, and social worker visits within these critical last days shows the benefits your hospice organization offers and the steps you take to care for your patients (which also factors into the new hospice index).

Where do you shine?

Now that you’ve created your unique story, next is figuring out where your organization shines.

Just like with home health, it’s important for your reps to target upstream. They should focus on connecting with the specialists who are seeing patients before they enter hospice.

It’s common for a hospitalist or a medical director to sign off for a patient to go into hospice, but the cardiologist or pulmonologist is the one who recommends hospice care for patients.

With the right information at hand, your rep can easily target the right specialist and create a talk track that discusses the importance of hospice and the strengths your organization provides to give their patients quality care in their last days.

How do you compare?

The last piece in perfecting your talk track is utilizing the data available to you and seeing where your organization compares to your competitors in the market.

Knowing specific details of your agency will help structure your story.

For example, if your organization has a lower hospitalization rate compared to your top competitor, you have a better chance of being the top destination for referral sources.

Besides utilizing your own data, your reps should understand the metrics within the Hospice Care Index to help them specify why you should be considered over your competitors.

Skilled Nursing Facilities (SNFs) data-driven messaging

What data is important to a SNF source – aka what data should you bring to a meeting with these referral targets?

When preparing to meet with referral sources, it’s important to assess your market and understand who your competitors are, which physicians refer to them, and how you can take over the top spot for referral destinations.

Once you’ve created a competitive analysis, you and your team can really dive into referral sources’ patient mix data, and see which physicians have a high number of patients that you specialize in.

It’s vital for your sales reps to understand market share and who gets referrals from where. Without the right data and tools to help them create the right messaging for high-value referrals, they may feel like they are heading upstream without a paddle.

How do you translate this data into a compelling message?

How to utilize data in your talk tracks

Now that you’ve collected your data, competitive analysis, and market share, how can you utilize that data to connect with referral sources?

Well, the best way is for your sales reps to take the data and incorporate it into their talk tracks. They can craft a message designed specifically for each physician to understand why they should send patients to your organization.

For example:

Your rep could communicate to a physician and say: “I saw that your heart rate patients stay in an inpatient setting on average 15 days which is 5 days higher than state averages. Have you ever thought about sending your patients to our SNF where they experience around the clock care but are not in the hospital inpatient unit?”

What’s your unique story

As mentioned before, when creating your unique story, it’s important to communicate your value and what your organization does best.

Do you have an elevator pitch?

Does your sales team understand your organization’s:

-

-

- Risk scores

- Operational metrics

- Strengths

-

In today’s value-based world, you can’t just rely on and discuss a star rating, there is a larger story to tell regarding your competitive positioning.

When connecting with referral sources and trying to get your foot in the door, sales reps need to communicate your agency’s value.

If your organization’s readmission rates are high, but you are seeing a patient that has a higher acuity complicated patient, the readmission rate is going to be higher since CMS calculates the rate with the lower scores in the market. However, if your organization has a lower readmission rate for cardiac, injury, and/or sepsis patients – that’s the story you should be focusing on.

Where do you shine?

Now that your unique story is complete, it’s time to show SNF referral sources where your organization shines.

Building upon the example from above, even though your readmission rates might be higher due to your organization working with high acuity patients, when it comes to readmission rates for injured patients – you have the lowest rate compared to the referral’s number one referral destination for injured patients.

Showcasing where your organization shines inside your reps’ talk track is an effective way to communicate with physicians the value your organization can provide and why you should be considered as the top referral source destination for their patients.

To prove why your organization should be a top referral destination, sales reps need to efficiently and effectively communicate your value to the physician.

How do you compare?

To round out your sales team talk tracks, now is the time to really dive into your competitive analysis and focus on what your organization does better than your competitor.

Taking it a step further with the example, without the in-depth data analysis in your talk track, referral sources might not have focused on the readmission rate on injured patients and only focused on the rates associated with the high acuity patients.

With data and competitive analytics – your sales reps can show with your organization as their top referral destination – the physician can start to lower their readmission rate for injured patients.

Utilize data for YOUR benefit

Not every organization has a third-party consultant or a market data platform where they can easily access the most up-to-date market intelligence. However, having a data-driven talk track for your team can help them convey the right messaging to the right physicians, therefore, ensuring they are spending less time preparing, and more time connecting.

So how do you access market data and insights? Do you know where you stand? And how do you highlight your strengths in against the competition? Maybe its time to take the next steps with Trella Health.

Interested in learning how to access the post-acute market data your team needs to tell your data-driven story? Schedule a personalized demonstration of Trella’s Health market insights platform and see how post-acute leaders are using actionable intelligence to execute and win more referrals with greater confidence.