Shelly Wing, Demand Generation Manager

Shelly is a passionate B2B marketing and content strategist. She creates and executes demand generation programs to make it easier for potential customers to learn about Trella’s solutions. She studied English at the University of Georgia before entering the world of sales and marketing. With experience in multifamily, SaaS, and IoT companies, Shelly consistently creates content that engages buyers at the right time and in the right way. At Trella Health, she’s excited about helping make a meaningful impact in all areas of post-acute healthcare.Benchmark Report Sneak Peek: 2022 Post-Acute ACO Partnerships in Focus

By Shelly Wing | November 12, 2021

Several weeks ago, we launched a survey to determine the post-acute growth strategies that owners, operators, and managers would be focused on in the new year. Given the impacts COVID-19 has had on the post-acute industry, it was clear to us here at Trella that traditional, linear growth wasn’t going to be the focus for every organization or line of business. Instead, post-acute ACO (or DCE) partnerships will also be a top priority.

We had over 150 respondents from various roles and post-acute care organizations (PACs). Our full report will be published at the beginning of December 2021, but there were some interesting facts that arose during our initial analysis – most notably, the increasing emphasis on participating in value-based care models as a growth strategy. And that’s exactly what we’re going to focus on today – how has value-based care impacted post-acute care planning and growth?

Methodology: Our Audience

Survey respondents selected both the primary and secondary priorities for each of the post-acute care organizations or facilities under their company’s umbrella. While some respondents only selected one line of business, many selected multiple, resulting in more total votes than individual respondents.

The breakdown of post-acute care settings represented in our survey included:

- Home Health: 79 or 52.67%

- Hospice: 73 or 48.67%

- Skilled Nursing: 43 or 28.67%

- IRF: 2 or 1.33%

- Home Care: 33 or 22%

- None of the Above: 6 or 4%

For the purposes of our survey and this analysis, we are only focusing on responses related to Home Health, Hospice, and Skilled Nursing.

Post-Acute ACO Partnerships: Key to Growth

In our effort to determine the overarching post-acute growth strategies for our target lines of business in 2022, we asked two simple questions for anyone involved with a home health, hospice, or skilled nursing facility or organization:

- What is your primary objective in 2022?

- What is your secondary objective in 2022?

For each question, the options remained the same. Respondents were asked to select one of the following options – one as their primary objective and one as their secondary:

- Increasing Admits/Referrals or (in the case of Skilled Nursing) Growing/Rebuilding Census

- Increasing Patients of a Specific Diagnostic Category

- Expanding to New Markets

- Mergers and Acquisitions

- Entering New Lines of Business

- Obtaining New Payment Model Certification

- Partnering with ACOs, DCEs, or other Value-Based Care Organizations

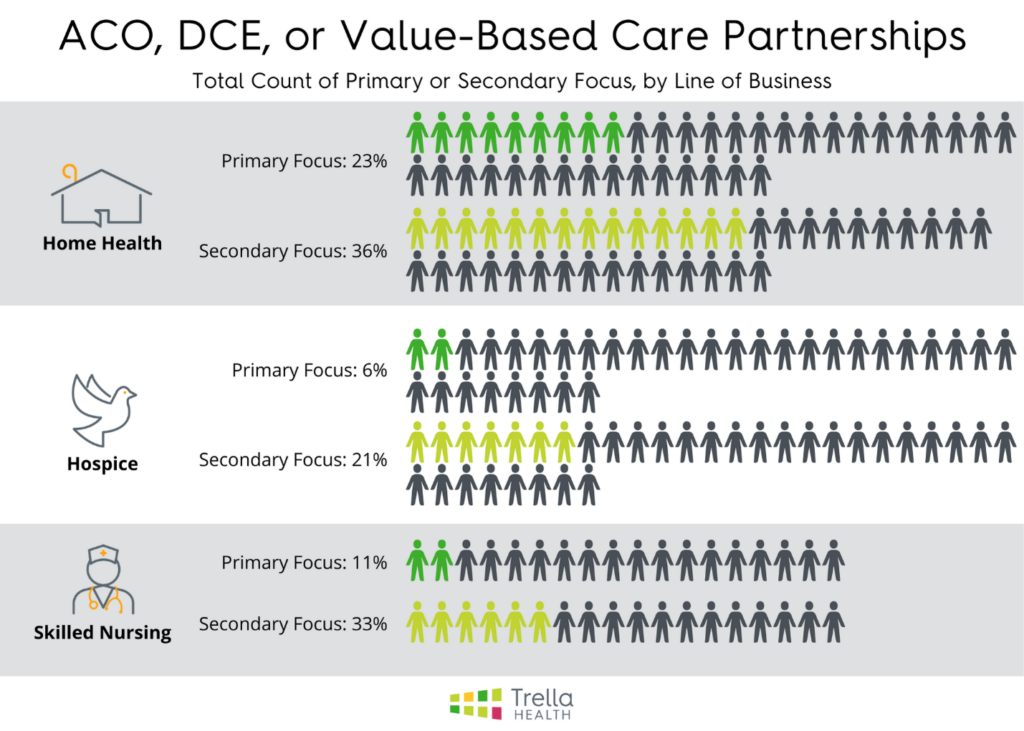

Through these questions, we had 181 unique answers. What interested our team most was the high percentage of responses pertaining to partnering with value-based care organizations and the variations between care settings.

In total, 22% (40 responses) indicated that partnering with value-based care organizations such as Accountable Care Organizations (ACOs) or Direct Contracting Entities (DCEs) was either their primary or secondary focus for the next year.

When broken down by care settings, both home health and skilled nursing respondents overwhelmingly affirmed that partnering with ACOs and DCEs was top of mind. Interestingly, however, hospice respondents had a larger percentage of focus placed on expanding to new markets.

What Does it Mean?

With a growing focus from CMS on patient outcomes and total patient costs under the umbrella of alternative payment models, value-based care is on the forefront of many health professionals’ minds. For PACs, ACO or DCE partnerships will likely prove to be a valuable avenue for long-term growth from both a referral and operational standpoint.

As covered in a recent report, “Biggest Opportunity for ACOs: Post-Acute Care Network Optimization,” per member, per year (PMPY) costs often increase when patients are referred to post-acute care destinations that do not meet their needs. And, because post-acute care accounts for 73% of Medicare spending variance, PAC partnerships are a straightforward way for ACOs and DCEs to improve their performance metrics.

For PACs looking to partner with ACOs and DCEs, it’s important to understand performance metrics, outcomes, and market data – all the while effectively communicating their value proposition.

Marketing and Sales Solutions for Post-Acute ACO and DCE Partnerships

Trella Health offers the most recent and complete Medicare claims data – including 100% of Part A and B claims as well as Medicare Advantage and commercial claims – giving our customers insight into 90% of covered lives in the U.S., aged 65+. But simply providing raw data isn’t enough. Our team of dedicated data scientists analyze over 2.9 billion claims per year and present them to our customers as actionable insights and market intelligence.

Sales Spotlight, one of Marketscape’s latest features, surfaces targeted conversation starters around metrics that matter to your referral partners so that you can enter every referral conversation with confidence, backed by unmatched data.

To learn more about Sales Spotlight, Marketscape, or other ways we can help your organization prove value and build essential partnerships with physicians, hospitals, and value-based care organizations, request a demonstration. We look forward to helping you set your PAC up for success in 2022!

And be sure to check your inbox in the coming weeks to receive the full 2022 Post-Acute Priority Benchmark Report and find out how your priorities align with the overall post-acute care industry.

Trella Health is the leader in market intelligence for the 65+ population, with extensive data sets including Medicare FFS, Medicare Advantage, commercial payers, ACOs, and DCEs. For more insights into how to stand out as a preferred referral partner, schedule a demo today.