Carter Bakkum, Senior Data Analyst, Healthcare Insights

Carter is a senior data analyst who works to turn complex, messy data into actionable intelligence. Carter studied economics and statistics at the University of Virginia before joining an economic consulting firm, where he supported expert testifying economic witnesses on behalf of fortune 500 healthcare companies. After the significant changes in the importance of data analytics during the pandemic, Carter joined the Trella team to dive deeper into the numbers to uncover the stories that drive our experience.5 Medicare Advantage Stats You Can’t Ignore

By Carter Bakkum | May 25, 2021

The Centers for Medicaid and Medicare Services (CMS) is finding ways to reduce overall Medicare spending without impacting the quality of patient care. Medicare Advantage has emerged as a reliable way to offer eligible enrollees a more cost-effective plan while shifting the burden of risk from the federal government to commercial payers. As noted in our 2020 Industry Trend Report, Medicare Advantage enrollments eclipsed 40% in Q2 of 2020 – a significant increase from 2017’s 33%. But what does the rising adoption of private plans by people over the age of 65 – and, more specifically, Medicare Advantage – mean for the post-acute care space? For many markets, visibility into this payer mix is no longer a “nice to have,” it’s a necessity.

The Trella Health data science team recently began analyzing Medicare Advantage and Commercial claims for the 65+ population, with data as recent as Q1 2021. Given the increasing importance of Medicare Advantage data, we’re excited to announce that Marketscape and Marketscape Strategy will both feature MA and commercial data for lives over 65 beginning Friday, May 28! In our research, we found compelling evidence of the importance of enhanced transparency into private payer claims in many markets. Here are five of the most compelling statistics and trends that we discovered:

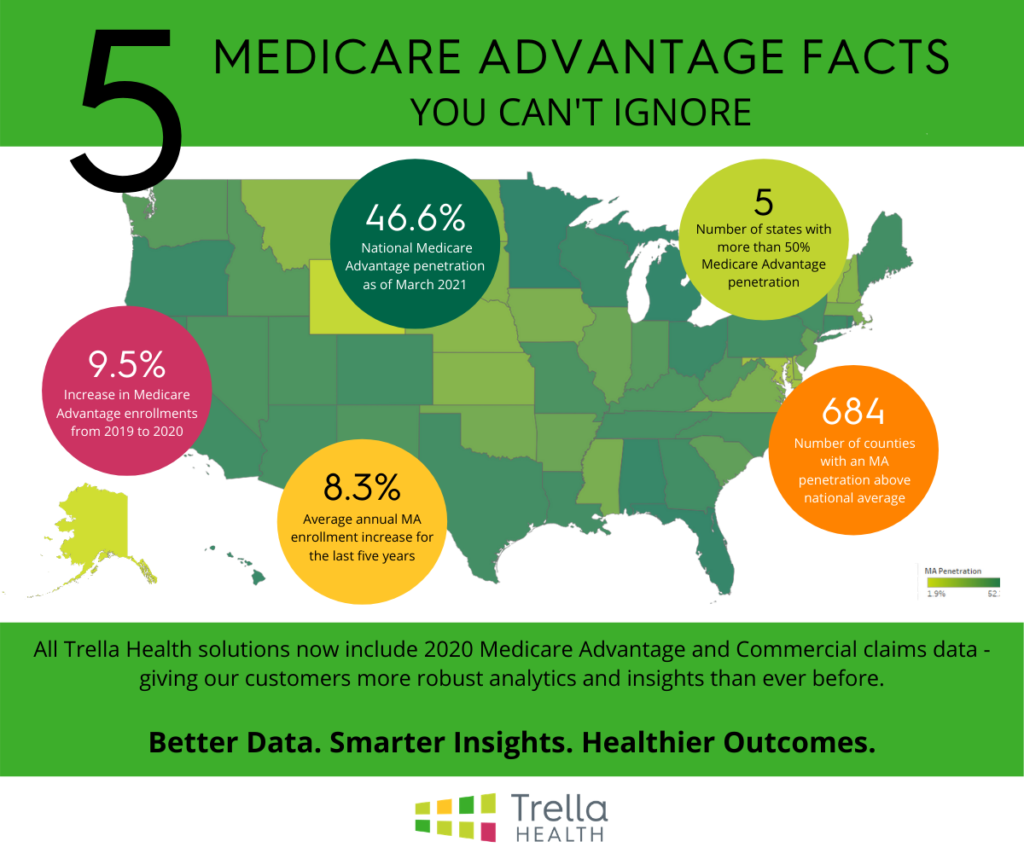

46.6%

The total National Medicare Advantage penetration as of March 2021. And this percentage is only expected to grow in the coming years.

9.5%

The increase in Medicare Advantage enrollments from 2019 to 2020. With an equally shocking 2.5% decrease in FFS enrollments between 2019 and 2020, it looks like this is one trend that’s not likely to slow down.

5

The number of states with more than 50% Medicare Advantage penetration as of Q4 2020. Post-Acute organizations in Minnesota, Michigan, Florida, Rhode Island, and Alabama need to be watching Medicare Advantage trends – these enrollees make up more than half of your eligible population, on average.

8.3%

The average year-over-year growth for Medicare Advantage enrollments for the last five full years (2016-2020). Conversely, Medicare Fee-for-Service (FFS) enrollment has decreased by an average of 1.1% in that same period.

684

The number of individual counties with a Medicare Advantage penetration higher than the national average. In fact, in Miami-Dade, Monroe, and Ottawa counties, more than 70% of the eligible population is enrolled in an MA plan.

A quick clarifying note: not every state or county follows these trends. Areas with lower population density, fewer physician choices, and a wider geographic range tend to have lower than average MA penetration. But for major metropolitan areas like Dallas, New York City, and Los Angeles, Medicare Advantage enrollment is increasing. Without visibility into these payers, you’re only seeing a portion of the trends in your market.

On May 28, 2021, Trella Health is adding more insights based on data through 2020-Q4 MA and Commercial 65+ claims to our solutions. Combined with 100% of the most recent FFS claims and 100% of MA claims from 2018 that we get from CMS, Trella Health now has data on 90% of all covered lives in the U.S. for people aged 65 and over! Our enhanced transparency gives you the tools you need to accelerate your business development and form better referral partner relationships.

To learn more about our upcoming data release or to see a sample of the market-level payer mix insights our customers get, request a demo today.